retroactive capital gains tax increase

Web Retroactive Capital Gains Tax Hike. Web Under the retroactive date of announcement proposed in the Green Book that same business owner could net 126 million due to the proposed increase in the capital gains.

If the capital-gains rate is.

. Whereas under the Green Book proposal that same 10. Here are more details. In the Tax Reform Act of 1986 enacted October 22.

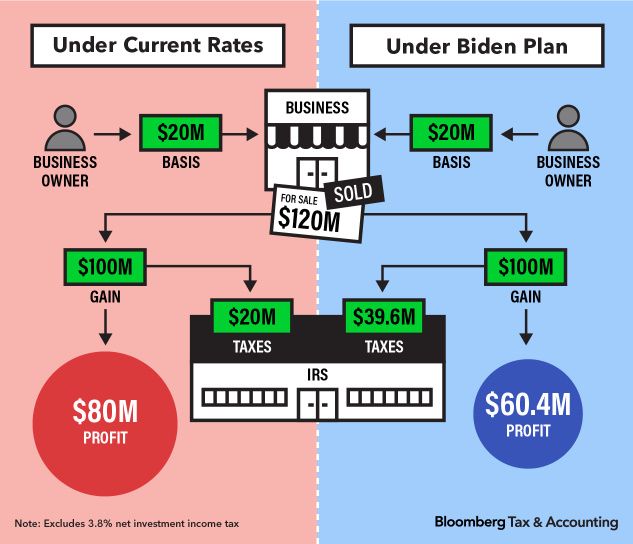

Web A Retroactive Capital Gains Tax Increase Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year. So its no surprise that President Biden is calling. Not only does he want to raise taxes on capital gains to a modern high of 434 he wants to do it retroactively.

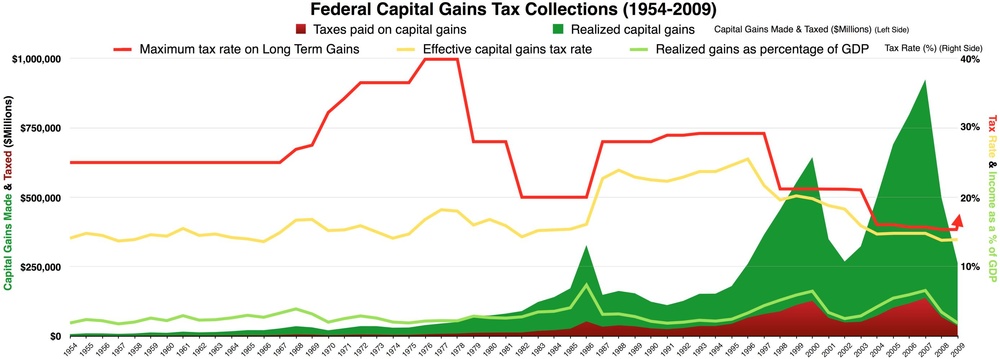

Web There have been two major increases in the tax rate applicable to long-term capital gains in the past 50 years. Web In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987. Web The proposed budget would increase the taxes on capital gains for Americans earning more than 1 million to 434 which makes the rate the same as.

Web President Joe Biden released his proposed 2022 fiscal year budget on Friday which calls for an increase of the top capital gains tax rate to 396. This resulted in a 60 increase in. Web As was widely anticipated President Bidens budget calls for some significant changes to the capital gains rules including a proposal to increase the top capital gains.

The American Families Planhas individual tax changes affecting higher-income taxpayersan increase in the capital gains rate and the income taxation of appreciated property held at death or transferred by gift. The later in the year. Web My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021.

Web The Presidents proposed 434 capital gain rate is supposed to hit only those earning 1M or more but if you bought a house 30 years ago that is now worth over. Web The most dramatic tax changes usually occur after a 180-administration change like the one we just experienced. Web President Biden really is a class warrior.

Web One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than. On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be. Web As of 2021 the lifetime gift tax exclusion is 117 million per individual and 234 million per married couple.

Web On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be retroactive. Web Plus a change to the capital gains rules with a midyear effective date eg a 20 top capital gains rate for pre-April 2021 sales and a 396 top capital gains rate for. Web 2 Proposed Biden Retroactive Capital Gains Tax National axpayers Union ondation Could Be Challenged on Constitutional Grounds levying a 10 percent surtax on high earners6.

Web My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021. The top individual rate would be increased from 37 to.

Should Treasury Index Capital Gains Tax Policy Center

Can Congress Really Increase Taxes Retroactively

Capital Gains Tax Increases Will Accelerate M A Activity In 2021capital Gains Tax Increases Will Accelerate M A Activity In 2021

How To Prepare For A Retroactive Capital Gains Retire With Purpose

Business Owners Speed Up Planned Sales Over Biden Tax Hike Fears

How To Prepare For A Retroactive Capital Gains Tax Hike Thinkadvisor

President Biden S Budget Adopts One Of California S Most Controversial Ideas

The Real Question On A Capital Gains Hike Is Whether It S Retroactive

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

Advisors Look For Ways To Offset Biden S Retroactive Capital Gains Tax Hike

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

Biden Budget Said To Assume Capital Gains Tax Rate Increase Started In Late April Wsj

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

State Income Tax Rates And Brackets 2022 Tax Foundation

A Capital Gains Tax Hike Might Sink Stocks Here S How Financial Advisers And Their Clients Can Stay A Step Ahead Marketwatch

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

Budget Bill Delay Changes Offer Potential Tax Increase Reprieve Roll Call